IPTV service has revolutionized the way we consume television content. With the rise of internet streaming, IPTV has become increasingly popular due to its convenience and extensive range of options. Whether you’re looking for live television channels or video-on-demand content, IPTV service providers have got you covered.

One such provider is "Atlasproontv.com," a leading IPTV service that offers subscriptions for a wide range of television channels and video-on-demand content. Their diverse collection includes both local and international channels, catering to a broad audience with varied interests. From sports to entertainment, news to educational content, Atlasproontv.com provides a plethora of choices for every viewer.

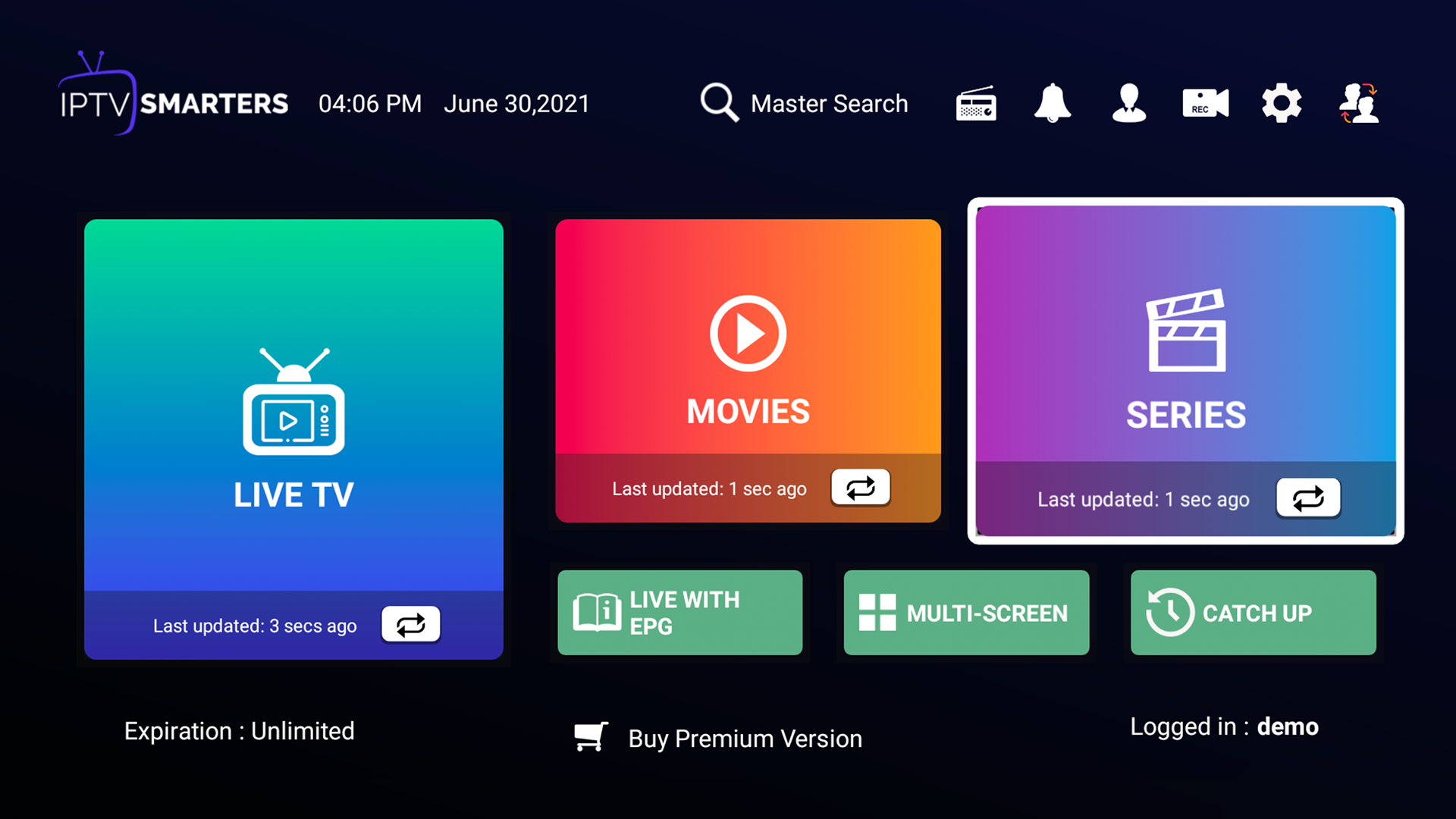

One of the key advantages of Atlasproontv.com is its compatibility with various devices. Whether you prefer to watch on a Smart TV or a mobile platform, you can easily access their content and enjoy a seamless viewing experience. No matter where you are or what device you have, you can stay entertained with their wide array of options.

In this ultimate guide, we will delve into the world of IPTV service, exploring its benefits, considerations, and how to choose the best provider for your needs. So, grab your favorite snack and get ready to embark on a journey to find the perfect IPTV service that will cater to your entertainment cravings.

Key Features of an IPTV Service

When it comes to choosing the best IPTV service, there are certain key features you should look out for. These features will not only ensure a seamless viewing experience but also enhance your overall satisfaction. Here are three important features to consider:

-

Wide Range of Television Channels:

A reliable IPTV service should offer a wide variety of television channels to cater to different interests and preferences. Whether you enjoy sports, movies, news, or entertainment, having a diverse selection of channels ensures that you never run out of options. Look for IPTV services that provide extensive channel lists, allowing you to access a broad range of content from around the world. -

Video-on-Demand Content:

In addition to live TV channels, a great IPTV service should also offer a robust library of video-on-demand (VOD) content. This feature allows you to access your favorite movies, TV shows, and other on-demand content at any time. Look for IPTV providers that offer a vast collection of VOD content, including the latest releases and popular TV series. Having this feature ensures that you can enjoy an extensive entertainment library whenever you want. -

Compatibility with Multiple Devices:

Flexibility is crucial when it comes to an IPTV service. Look for providers that are compatible with a wide range of devices such as Smart TVs, smartphones, tablets, and streaming devices. This allows you to enjoy your favorite content on the device of your choice, whether you’re at home or on the go. Having multi-device compatibility ensures that you have a seamless streaming experience across different platforms.

By considering these key features, you can make an informed decision when choosing the best IPTV service for your needs. A service that offers a wide range of television channels, an extensive library of video-on-demand content, and compatibility with various devices will greatly enhance your IPTV viewing experience.

Benefits of Choosing Atlasproontv.com

Atlasproontv.com is a top-rated IPTV service provider that offers a multitude of benefits to its subscribers. Whether you are a fan of live television channels or enjoy streaming video-on-demand content, choosing Atlasproontv.com can greatly enhance your viewing experience.

-

Wide Range of Television Channels: One of the most significant benefits of Atlasproontv.com is its extensive selection of television channels. With subscriptions available for a wide range of channels from all over the world, you can access your favorite content without any geographical limitations. From sports, news, and entertainment to documentaries and movies, there is something for everyone.

-

High-Quality Video-On-Demand Content: Atlasproontv.com not only provides access to live television channels but also offers a vast library of video-on-demand content. This means you can watch the latest movies, TV shows, and documentaries at your own convenience. The content is regularly updated, ensuring that you have an extensive collection of entertainment options to choose from.

-

Compatibility with Various Devices: Another standout feature of Atlasproontv.com is its compatibility with a wide range of devices. Whether you prefer watching on a Smart TV, laptop, smartphone, or tablet, you can easily access the service on your favorite device. This flexibility allows you to enjoy your favorite content wherever and whenever you want, without any restrictions.

Choosing Atlasproontv.com as your IPTV service provider offers numerous benefits, including a diverse range of television channels, high-quality video-on-demand content, and compatibility with various devices. With these advantages, you can elevate your entertainment experience and enjoy uninterrupted access to your favorite shows and movies.

Compatibility and Device Options

When it comes to choosing the best IPTV service, one crucial aspect to consider is compatibility with your devices. After all, you want to be able to access your favorite television channels and video-on-demand content seamlessly, regardless of whether you are using a Smart TV or a mobile platform.

One notable IPTV service provider that offers subscriptions for a wide range of television channels and video-on-demand content is "Atlasproontv.com." This service prides itself on its compatibility with various devices, ensuring that you can enjoy your favorite shows and movies on whichever platform you prefer.

Whether you own a Smart TV or prefer to watch content on your mobile phone or tablet, "Atlasproontv.com" has got you covered. Their IPTV service works seamlessly across different devices, allowing you to access your favorite programs wherever you go.

With "Atlasproontv.com," you don’t have to worry about limitations on compatibility. Their service caters to a diverse range of devices, ensuring that you can enjoy a smooth and hassle-free streaming experience on the device of your choice.

In conclusion, when looking for the best IPTV service, it is essential to consider compatibility and device options. With "Atlasproontv.com," you can rest assured that your chosen device, whether it’s a Smart TV or a mobile platform, will be fully compatible, allowing you to enjoy a wide selection of television channels and video-on-demand content at your convenience.

:max_bytes(150000):strip_icc()/81A5vrjlcSL._SX679_1-723fe4160cb5414f8d4014990e0808b6.jpg)