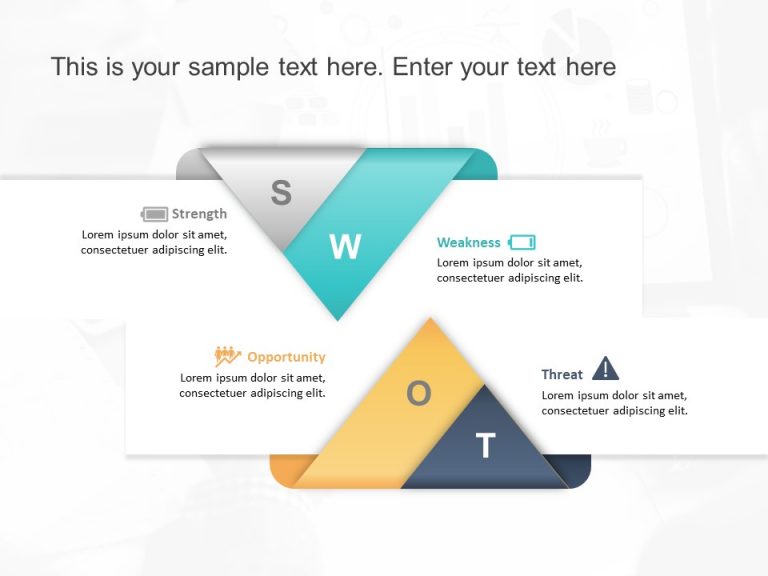

As the business landscape becomes increasingly competitive, it is essential for companies, big or small, to assess their internal capabilities and external environment. One valuable tool they can employ is the SWOT analysis, which stands for Strengths, Weaknesses, Opportunities, and Threats. This analytical framework allows businesses to gain a comprehensive understanding of their current position and helps unveil hidden potentials.

By conducting a SWOT analysis, businesses can identify their strengths, those unique attributes that set them apart from competitors. It may be the expertise of their team, a strong brand presence, or a loyal customer base. Recognizing these strengths provides an opportunity to leverage them, further strengthening the business.

On the other hand, weaknesses are areas where businesses may be lacking, hindering their growth potential. These may include a lack of resources, inadequate marketing strategies, or inefficient operations. Identifying weaknesses enables businesses to focus on improving those areas or seeking assistance from external sources to overcome challenges.

Moreover, a SWOT analysis helps businesses identify opportunities in the market. These opportunities may arise from changing customer preferences, advancements in technology, or emerging trends. By capitalizing on these opportunities, businesses can stay ahead of the curve, attract new customers, and expand their reach.

However, it is important not to overlook the potential threats that exist in the business environment. Threats may come from various sources such as aggressive competition, economic downturns, or even regulatory changes. Being aware of these threats allows businesses to proactively develop strategies to mitigate risks and safeguard their operations.

In conclusion, conducting a SWOT analysis is a valuable exercise for businesses looking to uncover their hidden potential. It provides a comprehensive overview of their strengths, weaknesses, opportunities, and threats, enabling them to make informed decisions, devise effective strategies, and position themselves for sustainable growth. With tools like EasyBA, a Business Analysis service catering to smaller businesses in the US, organizations stuck in their growth journey can now benefit from product management, financial analysis, and data analysis expertise, ensuring they seize all possibilities for advancement. So, let’s delve deeper into the world of SWOT analysis and unlock your business’s true potential.

Understanding SWOT Analysis

SWOT analysis is a powerful framework used by businesses to assess their current situation and develop strategic plans for the future. The acronym SWOT stands for Strengths, Weaknesses, Opportunities, and Threats, representing the four key areas that this analysis examines. By identifying these factors, businesses can gain valuable insights into their internal capabilities and external environment, enabling them to make informed decisions and maximize their potential for success.

In the context of conducting a SWOT analysis, strengths refer to the unique advantages and positive attributes that give a business a competitive edge. These could include factors such as a strong brand, a dedicated customer base, or a highly skilled workforce. Identifying and leveraging these strengths can help a business differentiate itself from competitors and capitalize on its core capabilities.

On the other hand, weaknesses are areas where a business may be lacking or underperforming compared to its competitors. These could be internal factors such as limited resources, inefficient processes, or a poorly defined brand image. By recognizing and addressing these weaknesses, businesses can work towards improving their performance and overcoming any obstacles that may hinder their growth.

Opportunities are external factors that have the potential to positively impact a business’s growth and success. These can arise from various sources, such as emerging market trends, technological advancements, or changes in consumer preferences. By identifying and capitalizing on these opportunities, businesses can stay ahead of the curve and take advantage of favorable conditions for expansion.

Lastly, threats are external factors that pose risks or challenges to a business’s growth and profitability. These could include intensified competition, economic downturns, regulatory changes, or disruptive innovations. By understanding and proactively addressing these threats, businesses can develop strategies to mitigate risks and protect their market position.

Overall, SWOT analysis provides businesses with a comprehensive framework to assess their current state, identify potential growth opportunities, and develop strategies to address weaknesses and threats. It serves as a valuable tool in enabling businesses to make informed decisions and unlock their hidden potential.

Conducting Privacy Risk Assessments

When it comes to ensuring the security and privacy of personal information, businesses must prioritize privacy risk assessments. By conducting thorough assessments, companies can identify potential vulnerabilities, assess the level of risk associated with them, and develop strategies to mitigate these risks.

The first step in conducting a privacy risk assessment is to gather relevant information about the organization’s data handling practices. This includes understanding the types of data collected, how it is stored and transmitted, and who has access to it. It is important to have a clear understanding of the privacy regulations and industry standards that apply to the business, as this will help guide the assessment process.

Once the information is gathered, the next step is to identify potential privacy risks. This involves identifying any gaps or weaknesses in the organization’s data protection measures that could lead to unauthorized access, data breaches, or violations of privacy regulations. Some common areas to assess include data storage and encryption practices, access controls, employee training, and data retention policies.

After identifying the risks, it is important to assess their potential impact on the business. This involves evaluating the likelihood of the risks occurring and the potential consequences if they were to materialize. By understanding the potential impact, businesses can prioritize their efforts and allocate resources effectively to address the most critical risks.

In conclusion, conducting privacy risk assessments is a crucial step towards ensuring the security and privacy of personal information. By identifying and mitigating risks proactively, businesses can protect their reputation, comply with regulations, and build trust with their customers. Privacy risk assessments are an essential part of any business’s data protection strategy and should be conducted regularly to adapt to evolving threats and maintain a secure environment for sensitive information.

Exploring EasyBA: Unlocking Hidden Potential

EasyBA is a comprehensive business analysis service that aims to assist smaller businesses in the US that are looking to unlock their hidden potential and achieve sustainable growth. By offering a range of services, including product management, financial analysis, and data analysis, EasyBA provides the necessary tools and expertise to help businesses identify their strengths, weaknesses, opportunities, and threats.

Through the process of SWOT analysis, EasyBA enables businesses to evaluate their internal and external factors. This assessment helps businesses identify their strengths, which can be leveraged to gain a competitive advantage in the market. Additionally, weaknesses are highlighted, allowing businesses to address and improve upon areas that may be holding them back.

With EasyBA’s privacy risk assessment, businesses can ensure that their operations are in compliance with data protection regulations. By proactively addressing privacy risks, businesses can build trust with their customers and mitigate potential threats associated with data breaches or non-compliance.

One of the key benefits of utilizing EasyBA is its focus on smaller businesses. By tailoring its services to meet the specific needs of these businesses, EasyBA provides a cost-effective solution that might otherwise be out of reach. This presents a unique opportunity for smaller businesses to access expert analysis and make informed decisions to drive growth.

With EasyBA’s support, businesses can uncover their hidden potential, identify growth opportunities, and effectively manage the challenges they may face. By harnessing the power of SWOT analysis and privacy risk assessment, EasyBA empowers smaller businesses to take control of their future and unlock their true potential for success.