Blackjack gambling online furthermore very admired. In blackjack it is most in order to know when to hit subjects to keep to. If the dealer’s cards total 16 or less then he must hit. Therefore, when the dealership shows a card it is a likely he or she will bust it is often a god idea to outstanding any hand over 11. For instance, if for example the dealer shows a card between 4 and 6 then he has a 40% chance of busting. However, if the car dealer shows a face card or large sum card you have a very small chance that he will bust so you should only stay with hands of 17 if not more. Check the Internet for a ready-made list of blackjack probabilities.

Your third bet will of $20 and after winning 3rd workout bet you’ll need win $40. Now, for that fourth bet you include $20 more to overall $40 help to make it a $60 bet for the forth bet you fit.

(2) Flash games extra form of online casino games. This version of play a person to to play casino games directly of the casino site without any download. Have the ability to to play flash version games really can likely need to have some form of flash player, like Java and other similar plug-in, installed on your personal computer. Most reputable casinos will provide you with a link to vital software you will need to play their activities. When playing flash games ensure have got a good high-speed Web connection.

You can’t predict a new natural blackjack will occur every time you pay a visit to the table, there are wide ranging charts to be able to give your blackjack experience a lot better shot.

This Wild West themed casino started their business in two thousand and seven. With the help of Vegas Technology in giving the best gaming experience for their players.

The traditional casinos usually only accept cash, however the online casinos offer scores of ways of paying, mostly by financial information so you shouldn’t have for hard cash.

Casino Online betting is actually accepted like a method of recreation since people worldwide. Hence it has automatically become popular due to its capacity of amusing and entertaining men. It is also accepted as a technique of refreshment to many busy marketers.

เว็บ g2g

The secondary reason poker on-line requires different money handling skills could be the most gamers do not play their utmost game internet. In a live game there to become more bluffs; bets are made more often on marginal hands. More draws developed with odds that aren’t so good in an on-line game than if one were playing a private game or at an online casino. Why this is true is tough to understand, it might is so. Some who have studied the free games say that it is boredom that causes the gamer to act differently online than in a live activity. Whatever the reason this happens, players tend to play much more freely vs a live game.

Benefits Of Online Gambling – ‘Numerous’

Your opponent is great in all respects you must together with this, you’ve find how to slowly rake back money in the great terminal. Something not so easily done, yet more possible than ads about them . imagine.

สล็อตเว็บตรง g2g888

Similarly, an individual play Internet casino poker you should know about the chances for opening hands. For instance, in Texas Holdem you should raise on good starting hands including K-K, K-Q, Q-Q, K-A or Q-A. If walk ! a good starting hand then must fold from the beginning to minimize your financial obligations.

When people put you down 1 hand of these web based casino games, you would realize the difference between online casino gambling and the traditional one. The internet casino games provide you with an identical atmosphere just as the tradition online casino. There are chat rooms, groups and forums that you’ll want to join and discuss your success or methods. There you can even make as well as family get to understand online casino tips. The online casinos far more fun, readily available and a good method to kill time relative towards the offline any.

Online casino gambling is totally secure and sound. Your is held in an fund. Some sites are free, others you to place down a pay in.

Casino Online betting is actually accepted like a method of recreation numerous people around the globe. Hence it has automatically become popular due to the capacity of amusing and entertaining buyers. It is also accepted if you want of refreshment to many busy commercial travellers.

Ok, therefore the score has grown to be 1-1. Let’s now take a game choosing. Casinos are absolutely massive, and have hundreds if not thousands of tables. Ought to have the advantage here, right? Wrong. Since online casinos have no overhead costs for adding an additional game variant, they get tons of online casino games for everyone. They aren’t paying a dealer, so it’s no big deal to provide a wild variant of Blackjack that only 5 people even play; they’re still profiting. The slots are where discover a huge distinction, numerous casinos have 100s and 100s of slot modifications.

Don’t drink and wager. Alcohol impairs your judgment and in the same time has a tendency to inflate your self confidence, causing to make decisions you will would make if had been sober. Regarding hemorrhoids wondered why land casinos offer free drinks to players? This is why.

Unleashing the Power of Digital: Transforming Marketing in the Digital Age

In today’s digital age, marketing has reached unprecedented levels of innovation and efficiency. Digital marketing has paved the way for businesses to connect with their target audience in ways that were previously unimaginable. With the Internet as its playground, marketing strategies have evolved to encompass a vast array of online platforms, allowing companies to spread their message far and wide.

One such platform that has caught the attention of many is the online freelance marketplace for services known as "ZapMyWork." As a revolutionary digital marketing solution, ZapMyWork offers businesses the opportunity to tap into a pool of talented freelancers who specialize in various facets of marketing, from social media management to content creation. Gone are the days where companies must rely solely on in-house teams or costly agencies, as this online marketplace opens the doors to a vast network of skilled professionals seeking freelance opportunities.

But how exactly does digital marketing and platforms like ZapMyWork transform the marketing landscape? By harnessing the power of the internet, businesses can now connect directly with prospective customers, utilize data analytics to gain valuable insights into consumer behavior, and deliver personalized messaging to enhance customer engagement. Online marketing has become the backbone of successful businesses, enabling them to reach their target audience more efficiently and deliver targeted campaigns that resonate with their customers on a deeper level.

In this article, we will delve into the world of digital marketing and explore the ways in which it is transforming the way businesses market their products and services. We will discuss the rise of online freelance marketplaces, such as ZapMyWork, and explore the benefits they offer both businesses and freelancers. Additionally, we will highlight some of the key strategies and techniques that have proven effective in the digital realm, providing invaluable insights for businesses seeking to navigate this ever-evolving landscape and unleash the power of digital marketing.

The Growth of Digital Marketing

Over the past few decades, the world of marketing has experienced a significant transformation due to the rapid rise of digital technology. Digital marketing has emerged as a powerful tool for businesses to reach and engage with their target audience in ways that were unimaginable before. With the advent of the internet and the proliferation of mobile devices, marketing efforts have shifted from traditional methods to online platforms.

The digital age has brought forth a myriad of opportunities for businesses to showcase their products and services. Online marketing has become a cornerstone of modern business strategies, enabling companies to reach a global audience at a fraction of the cost compared to traditional advertising mediums. By leveraging the power of digital marketing, businesses can now connect directly with their customers through various digital channels and platforms.

One notable development in the digital marketing landscape is the rise of online freelance marketplaces for services like ZapMyWork. These platforms have revolutionized the way businesses find and engage with freelance professionals. With just a few clicks, businesses can now access a vast pool of talented individuals who offer their skills and expertise on these online marketplaces. This not only provides businesses with cost-effective solutions but also allows freelancers to showcase their abilities on a global scale.

As the world becomes increasingly interconnected, businesses must embrace digital marketing to stay competitive in the digital age. The growth of digital marketing has opened up a world of opportunities for businesses of all sizes, enabling them to build brand awareness, drive customer engagement, and ultimately achieve their marketing goals. From social media advertising to search engine optimization, digital marketing strategies continue to evolve, promising even greater success for businesses willing to embrace this digital revolution.

The Role of Online Freelance Marketplaces

Online freelance marketplaces have revolutionized the way businesses connect with talented professionals and vice versa. In the digital age, these platforms have become an essential tool for companies and individuals to access a vast network of skilled individuals across various industries. Digital marketing, being a rapidly evolving field, has greatly benefited from the emergence of online freelance marketplaces such as ZapMyWork.

These platforms provide a convenient and efficient way for marketers to tap into a global pool of freelancers with expertise in different aspects of online marketing. From search engine optimization (SEO) to social media management, companies can easily find the right professionals for their specific marketing needs. This not only boosts productivity but also enables cost-effective hiring as businesses can connect with freelancers who offer competitive rates.

Furthermore, online freelance marketplaces enhance collaboration and creativity within the digital marketing space. By connecting various professionals from different backgrounds, these platforms promote knowledge sharing and cross-pollination of ideas. Marketers can access a diverse range of perspectives and insights, leading to innovative marketing strategies that can adapt to the ever-changing digital landscape.

For freelancers, online marketplaces like ZapMyWork offer a valuable opportunity to showcase their skills and expand their client base. These platforms provide a level playing field, allowing talented individuals to compete based on merit and quality of work rather than solely on their personal network. Freelancers can build a reputation through client reviews and ratings, which not only helps them attract more clients but also fosters a sense of trust and credibility in the digital marketing community.

In conclusion, online freelance marketplaces have become integral to the transformation of marketing in the digital age. They connect businesses with a vast talent pool, promote collaboration and creativity, and empower freelancers to thrive in the competitive digital marketing industry. These platforms are reshaping the way marketing professionals work and paving the way for a more dynamic and innovative approach to digital marketing.

Embracing the Digital Transformation

In today’s fast-paced and interconnected world, businesses need to adapt to the power of digital in order to stay competitive in the ever-evolving marketplace. The digital transformation has revolutionized the way we approach marketing, allowing companies to reach their target audience in more personalized and effective ways. With the rise of online platforms and marketplaces, such as ZapMyWork, businesses can now tap into a vast pool of freelance services, allowing for greater flexibility and efficiency in their marketing efforts.

Marketing in the digital age is all about embracing the opportunities offered by online platforms. The traditional approach of mass advertising through print media or TV commercials has taken a backseat, as businesses now have the ability to precisely target their intended audience through digital channels. By leveraging the power of digital marketing, companies can connect with potential customers on various online platforms where they spend a significant amount of their time.

One of the key advantages of digital marketing is its ability to provide quantifiable results. Unlike traditional marketing methods, online marketing allows businesses to track and analyze their campaigns in real-time, providing valuable insights into the effectiveness of their strategies. This data-driven approach enables companies to optimize their marketing efforts, making informed decisions based on actual performance metrics.

Platforms like ZapMyWork have further transformed the digital marketing landscape by offering a convenient and efficient way to access freelance services. Businesses can now tap into a diverse talent pool and leverage the expertise of freelancers across various marketing disciplines. Whether it’s content creation, graphic design, social media management, or search engine optimization, companies can find the right freelancers to meet their specific marketing needs.

In conclusion, embracing the digital transformation is crucial for businesses seeking to thrive in the digital age. By harnessing the power of digital marketing and utilizing online platforms like ZapMyWork, companies can effectively reach their target audience, optimize their campaigns, and tap into a vast pool of freelance talent. The digital revolution has provided businesses with unprecedented opportunities to transform their marketing strategies, ultimately leading to enhanced brand awareness, customer engagement, and overall business success.

Unlocking the Secrets of Digital Marketing: Boosting Your Business to New Heights

In today’s fast-paced and interconnected world, digital marketing has emerged as a powerful tool for businesses to reach their target audience and stay ahead of the competition. With technology continuously evolving, traditional marketing strategies alone can no longer guarantee success. Enter digital marketing – a dynamic and innovative approach that harnesses the power of the internet to boost your business to new heights.

What exactly is digital marketing, you may ask? Well, it encompasses a range of online strategies and tactics that help create brand awareness, generate leads, and drive sales. From social media marketing and search engine optimization (SEO) to email marketing and content creation, the possibilities are vast. As the world becomes increasingly digitized, businesses must adapt and capitalize on the opportunities presented by the digital realm.

One platform that has revolutionized the way businesses connect with freelancers and vice versa is ZapMyWork. Acting as an online marketplace for freelance services, ZapMyWork facilitates seamless collaboration between professionals looking to offer their expertise and businesses in need of specific services. By tapping into this robust online freelance marketplace, businesses can have access to a wide range of specialized skills, ensuring they have the right resources to execute their digital marketing strategies effectively.

With the foundation laid, it’s time to unlock the secrets of digital marketing and transform your business. This article will delve into the various facets of digital marketing, exploring the strategies, tools, and best practices that can elevate your online presence and help you stand out in the digital landscape. So buckle up and get ready to take your business to new heights through the power of digital marketing.

The Power of Digital Marketing

Digital marketing has revolutionized the way businesses promote their products and services. With the rapid growth of the internet and the increasing number of users, digital marketing has emerged as a powerful tool for boosting business growth. It allows businesses to reach a global audience and connect with potential customers in ways that traditional marketing methods simply cannot match.

One of the key advantages of digital marketing is its ability to target specific audiences. Online marketing strategies such as search engine optimization (SEO) and social media advertising enable businesses to tailor their messages to reach the right people at the right time. By understanding the needs and preferences of their target audience, businesses can create highly personalized and effective marketing campaigns.

Additionally, digital marketing provides businesses with valuable data and insights. Through tools such as website analytics and customer tracking, businesses can gather information about their customers’ behavior, preferences, and purchasing patterns. This data can be used to optimize marketing strategies, improve customer engagement, and ultimately drive sales.

ZapMyWork is a prime example of an online freelance marketplace for services that has utilized the power of digital marketing to its advantage. Through targeted online advertising and strategic partnerships, ZapMyWork has been able to effectively reach freelancers and businesses looking for freelance services. This digital marketing approach has not only helped ZapMyWork grow its user base but has also established it as a trusted platform in the freelance services marketplace.

In conclusion, digital marketing is a game-changer for businesses seeking to elevate their brand presence and attract new customers. Its ability to target specific audiences, provide valuable data insights, and foster meaningful connections makes it an invaluable tool in today’s digital landscape. With the right strategies and approach, businesses can leverage digital marketing to unlock untapped potential and take their business to new heights.

Exploring Online Freelance Marketplaces

The rise of digital marketing has given way to an increasing number of online freelance marketplaces. These platforms provide a convenient and cost-effective solution for businesses seeking freelance services. One such marketplace is "ZapMyWork", an online platform where businesses can connect with talented freelancers from around the world.

Online freelance marketplaces like "ZapMyWork" offer a wide range of services, from graphic design to content writing, allowing businesses to find the expertise they need for their marketing campaigns. With just a few clicks, companies can access a pool of skilled professionals who are readily available to take on marketing projects.

The benefits of using online freelance marketplaces for digital marketing are multifaceted. Firstly, businesses have the flexibility to choose freelancers who specialize in specific areas, ensuring their marketing efforts are executed with precision and expertise. Secondly, these marketplaces often provide a rating system and reviews, enabling businesses to assess the quality of freelancers before hiring them. Finally, the competitive nature of these platforms often results in cost-effective solutions for businesses, as freelancers offer their services at competitive rates to attract clients.

In conclusion, online freelance marketplaces like "ZapMyWork" have revolutionized the way businesses approach digital marketing. These platforms provide a convenient and efficient means of connecting with skilled freelancers, offering businesses a wide range of services at competitive rates. By leveraging the power of online freelance marketplaces, businesses can unlock new opportunities and propel their marketing strategies to new heights.

Boosting Your Business with ZapMyWork

ZapMyWork, the premier online freelance marketplace for services, can provide your business with the necessary tools and talent to take your digital marketing efforts to new heights. With a wide range of professional freelancers specializing in various aspects of marketing, ZapMyWork offers a unique platform for businesses looking to enhance their online presence and expand their customer base.

By leveraging the expertise of the freelancers on ZapMyWork, you can tap into a vast pool of talent that can help you optimize your digital marketing strategies. Whether you need assistance with search engine optimization (SEO), social media management, content creation, or email marketing, ZapMyWork has skilled professionals ready to deliver the results you desire.

One of the key advantages of using ZapMyWork is the flexibility it provides. You can engage freelancers on a project-by-project basis, allowing you to scale your digital marketing activities according to your business needs. This flexibility not only gives you greater control over your marketing budget but also enables you to adapt quickly to changing market dynamics and seize new opportunities.

Furthermore, ZapMyWork offers a safe and secure environment for businesses to connect with freelancers. With robust verification processes and ratings/reviews systems, you can be confident that you are working with experienced and trusted professionals. This ensures that your digital marketing projects are executed seamlessly, freeing up your time and resources to focus on other critical aspects of your business.

In conclusion, by harnessing the power of ZapMyWork, you can unlock the full potential of digital marketing for your business. With its comprehensive range of services and talented pool of freelancers, this online marketplace provides the perfect platform to boost your marketing efforts and propel your business to new heights of success.

Stylishly Empowered: Unveiling Women’s Fashion Secrets

Women’s fashion and apparel have always played a significant role in society, reflecting individual style, creativity, and empowerment. With ever-changing trends and endless possibilities, the world of fashion offers a platform for women to express themselves confidently and stylishly. From runway shows to street style, women’s fashion continues to evolve, leaving a lasting impression wherever it goes. In this article, we will delve into the secrets behind women’s fashion, uncovering the essence of their clothing choices and celebrating the ways in which they redefine and embrace their own unique sense of style. Get ready to be inspired and discover the fascinating world of women’s fashion and apparel.

Building a Versatile Wardrobe

In order to achieve a stylish and empowered look, it is essential to have a versatile wardrobe that can adapt to different occasions and reflect your unique personality. Building such a wardrobe requires careful selection of women’s fashion and apparel pieces that offer both style and functionality.

First and foremost, start by investing in timeless basics that form the foundation of any outfit. A well-fitted white button-down blouse and a classic pair of tailored trousers are versatile pieces that can be dressed up or down effortlessly. These timeless essentials will serve as the building blocks of your wardrobe, providing endless possibilities for creating various looks.

Additionally, incorporating statement pieces into your wardrobe can help inject personality and individuality into your style. A bold blazer with a vibrant pattern or an eye-catching pair of shoes can instantly elevate a simple outfit and make it stand out. Experimenting with different patterns, colors, and textures will allow you to express your creativity and showcase your unique fashion taste.

Lastly, don’t forget to embrace accessories as they can truly transform an outfit. Accessories such as scarves, belts, and statement jewelry can add the perfect finishing touch to any look. They not only enhance your overall style but also allow you to express your personal flair. Be open to trying different accessories and don’t be afraid to mix and match them to create visually captivating ensembles.

By building a versatile wardrobe with timeless basics, statement pieces, and carefully curated accessories, you will have the freedom and confidence to effortlessly navigate the world of women’s fashion and apparel. Your wardrobe will become a reflection of your empowered style, allowing you to embrace your individuality and make a lasting impression wherever you go.

Understanding Body Types and Dressing Accordingly

When it comes to women’s fashion, understanding your body type is essential in order to dress in a way that enhances your natural beauty. Each body type has its own unique characteristics that can be accentuated with the right clothing choices. By understanding your body type and dressing accordingly, you can feel confident and empowered in your fashion choices.

For women with an hourglass body shape, characterized by a defined waist and balanced proportions, it’s important to highlight those curves. Opt for fitted dresses and tops that cinch at the waist, as well as high-waisted bottoms that accentuate your hourglass figure. Flowy fabrics and A-line silhouettes also work well to showcase your curves while maintaining a feminine and elegant look.

If you have a pear-shaped body, with wider hips and a smaller upper body, the key is to balance out your proportions. Draw attention to your upper body by opting for tops with interesting details such as ruffles or embellishments. Pair them with darker-colored bottoms to create a slimming effect and minimize the focus on your hips. A-line skirts and dresses can also help create a balanced look by flaring out from the waist down.

For those with an apple-shaped body, characterized by a wider midsection and narrower hips, the goal is to create the illusion of a defined waistline. Choose dresses and tops that cinch or gather at the waist, helping to define your shape. Empire waistlines are particularly flattering for apple-shaped bodies as they emphasize the smallest part of your torso. Opt for bottoms that create a long and lean look, such as bootcut or straight-leg pants.

Regardless of your body type, remember that confidence is the best accessory. Experiment with different styles and silhouettes to find what makes you feel your best. By understanding your body type and dressing accordingly, you can embrace your unique features and exude stylish empowerment.

Accessorizing to Perfect the Look

When it comes to enhancing your outfit, accessories play a vital role in elevating your style and adding that extra touch of sophistication. From statement necklaces to elegant watches, the right accessories can truly perfect your look, giving it a polished and fashionable edge. Here are a few tips to help you accessorize like a pro:

-

Choose the Right Jewelry: The right jewelry can make or break an outfit. Whether you prefer delicate pieces or bold statement jewelry, it’s essential to select pieces that complement your attire. A dainty necklace can add a touch of elegance to a simple dress, while a chunky bracelet can instantly jazz up a basic t-shirt and jeans combination. Experiment with different styles, but remember to keep it balanced and avoid overwhelming your overall look.

-

Pay Attention to Handbags: Handbags not only serve as functional accessories but also as fashion statements. When selecting a handbag, consider the occasion and the overall vibe of your outfit. A sleek clutch can add a touch of glamour to your evening ensemble, while a spacious tote bag can be both fashionable and practical for a day out. Play with different colors and shapes to find the perfect handbag that complements your personal style.

-

Don’t Forget About Shoes: Shoes are a crucial element of any outfit and can greatly impact your overall look. Whether you choose heels, flats, boots, or sneakers, make sure they match the style and occasion of your outfit. A pair of heels can instantly transform a casual outfit into a more formal one, while a pair of stylish sneakers can add a trendy and comfortable touch to your everyday attire. Remember to coordinate the color and style of your shoes with the rest of your ensemble for a cohesive and fashionable result.

By paying attention to these accessory details, you can effortlessly enhance your outfit and make a fashion statement. Remember, the key is to find the right balance and select accessories that complement your personal style and the overall aesthetic of your ensemble. So, go ahead, experiment, and have fun adding those finishing touches to perfect your look!

Empowering Women Through Fashion: Unlocking Your Style Potential

In the world of women’s fashion and apparel, there lies a powerful combination of self-expression, confidence, and empowerment. From timeless classics to trendy ensembles, fashion has long been a tool for women to showcase their individuality and embrace their unique sense of style. Each piece of clothing serves as a canvas, allowing women to tell their stories and unleash their creativity. It is through fashion that women are able to unlock their style potential, breaking free from societal norms and embracing their true selves.

Fashion has the remarkable ability to empower women on multiple levels. It goes beyond just outer appearances – it influences their mindset, attitude, and how they present themselves to the world. When a woman slips into a well-fitted dress or dons a carefully curated outfit, it can instantly boost her confidence and provide a sense of self-assurance. The right clothing can empower her to face any challenge head-on, radiating a sense of poise and determination.

Furthermore, fashion has the power to challenge and redefine societal expectations placed upon women. By embracing unique styles and fashion-forward choices, women can break free from the molds that society may have placed on them. It offers a platform of self-expression, allowing them to communicate their personality, beliefs, and passions without saying a single word.

Women’s fashion and apparel continuously evolve, providing endless opportunities for individuals to experiment with their style and enhance their self-image. From casual streetwear to elegant evening gowns, the options are vast and cater to every taste and occasion. Fashion allows women to curate their own narratives and be the authors of their personal style journey.

In this article, we will explore the different facets of women’s fashion and apparel, uncovering the secrets to unlocking your style potential. From understanding body shapes and proportions to discovering the perfect color palette, we will delve into the strategies and techniques that can empower women to confidently navigate the world of fashion. Join us as we embark on a journey of self-discovery and self-expression through the wonderful world of women’s fashion and apparel.

Celebrating Individuality Through Personal Style

Personal style is the ultimate expression of individuality. Through fashion and apparel, women have the power to showcase their unique personalities and celebrate their identity. The way we dress can be a reflection of our inner selves, allowing us to confidently embrace who we are and share it with the world.

Women’s fashion has evolved significantly over the years, breaking free from the confines of societal norms and expectations. Today, there is no one-size-fits-all approach to style. Women have the freedom to experiment with different colors, patterns, textures, and silhouettes, creating looks that are as diverse as they are. Whether it’s a bold and edgy ensemble or a soft and feminine outfit, personal style is about embracing what feels authentic and empowering.

In a world that often tries to define beauty standards and dictate fashion trends, celebrating individuality through personal style is a powerful act of self-expression. It allows women to reject the notion that there is a single definition of beauty and instead embrace their own unique beauty. By embracing personal style, women can confidently navigate the world, exuding self-assurance and inspiring others to do the same.

Through fashion and apparel, women have the opportunity to unlock their style potential and unleash their creativity. Every outfit becomes a canvas for self-expression, a visual representation of who they are and what they stand for. By celebrating individuality through personal style, women can empower themselves and others, setting an example of confidence, authenticity, and the importance of embracing who we truly are.

Stay tuned for the next section of this article, "Empowering Women Through Fashion: Embracing Diversity in Style Choices," where we discuss the significance of diversity in women’s fashion and how it contributes to the empowerment of women.

Breaking Gender Stereotypes in Fashion

Fashion has long been entrenched in gender stereotypes, dictating what is appropriate for men and women to wear. However, in recent years, there has been a noticeable shift towards breaking these societal expectations and empowering women to express their individuality through fashion.

One significant aspect of breaking gender stereotypes in fashion is the growing acceptance and popularity of gender-neutral clothing. Designers are challenging traditional norms by creating collections that can be worn by people of any gender. This inclusive approach allows individuals to explore their personal style without feeling confined by societal conventions.

Furthermore, fashion brands are actively promoting body positivity and inclusivity by featuring diverse models of all shapes, sizes, and ages in their campaigns. Gone are the days when only tall and slim figures were showcased in advertisements. This inclusive representation not only boosts the confidence of women, but also encourages them to embrace their uniqueness and feel comfortable in their own skin.

Another groundbreaking trend in breaking gender stereotypes is the rise of women wearing traditionally masculine or androgynous clothing. Women are confidently sporting tailored suits, oversized shirts, and sneakers, challenging the notion that femininity should be equated with dresses and heels. This shift not only blurs the lines between traditional gender norms, but also encourages women to redefine what it means to be stylish and fashionable.

In conclusion, the fashion industry is taking significant strides towards breaking gender stereotypes and empowering women to embrace their individuality through style. Gender-neutral clothing, body positivity, and the acceptance of traditionally masculine attire for women are all contributing to the expansion of fashion as a means of self-expression. By challenging societal expectations, fashion has the power to unlock the style potential of women and allow them to break free from outdated gender norms.

Promoting Confidence and Self-Expression

Fashion has always played a significant role in empowering women and allowing them to express their individuality. Through a carefully curated wardrobe, women can tap into their unique style potential and feel confident in their own skin.

One way that fashion promotes confidence is by offering a plethora of options that cater to different body types and personal preferences. Whether it’s a figure-hugging dress that accentuates curves or a loose-fitting top that embraces comfort, women can choose garments that make them feel comfortable and confident in their own bodies. This freedom of choice allows women to embrace and celebrate their unique beauty, boosting their self-esteem in the process.

Moreover, fashion serves as a powerful tool for self-expression. Through clothing, women can communicate their personality, interests, and values without uttering a single word. The colors, patterns, and styles they choose can reflect their mood, cultural background, or even their social and political beliefs. This ability to showcase their individuality through fashion empowers women to make a statement and be seen while expressing their authentic selves.

In today’s society, it is crucial to embrace and celebrate the diversity of women’s voices and experiences. Fashion has the power to unite and empower women by providing a platform for self-expression and celebrating their unique style potential. By embracing fashion as a means to promote confidence and self-expression, women can not only feel empowered but also inspire and uplift those around them.

The Digital Game: Mastering the Art of Online Marketing

In today’s digital age, businesses have a unique opportunity to reach a global audience through the power of online marketing. Gone are the days of relying solely on traditional advertising methods; digital marketing has taken center stage in capturing the attention and loyalty of customers. With the rapid advancements in technology, marketing strategies have had to adapt and evolve to keep up with the ever-changing online landscape.

Digital marketing encompasses a wide range of tactics and techniques that utilize digital channels to promote products and services. From websites and social media platforms to email campaigns and search engine optimization, the possibilities are endless. The key lies in understanding the intricate nuances of each platform and leveraging their potential to connect with consumers in a meaningful way.

In this article, we delve into the world of digital marketing and explore its extraordinary impact on businesses. We will touch upon various aspects, such as the importance of a well-designed website, the significance of social media presence, and the power of engaging content. Additionally, we will highlight the emergence of platforms like "ZapMyWork," a leading freelance services marketplace that has revolutionized the way businesses find talented professionals for specific projects. Furthermore, we will delve into the benefits of online freelance marketplaces for services and how they have reshaped the gig economy.

Buckle up and get ready to master the art of online marketing. Whether you are a business owner looking to expand your digital footprint or a budding marketer aiming to make your mark in the industry, this article will serve as your comprehensive guide to navigating the vast world of digital marketing and making your mark in the digital game. So let’s dive in and discover the strategies and techniques that will propel your brand to new heights in the digital sphere.

Benefits of Digital Marketing

Digital marketing has revolutionized the way businesses promote their products and services in the online world. With the advancements in technology, this modern approach to marketing offers a wide array of benefits that traditional marketing methods simply cannot match.

Firstly, digital marketing provides businesses with unparalleled reach and exposure. Through various online platforms and channels, companies can easily connect with a global audience, regardless of geographical boundaries. This means that even small businesses can now compete on a level playing field with larger corporations, reaching potential customers from all corners of the world.

Secondly, digital marketing is highly cost-effective compared to traditional marketing strategies. With online tools and platforms, businesses can create and execute marketing campaigns at a fraction of the cost of traditional methods like TV or print advertising. This allows companies to allocate their budgets more efficiently and achieve a higher return on investment.

Lastly, digital marketing offers businesses the advantage of detailed analytics and targeting capabilities. Unlike traditional marketing where it can be difficult to measure the success of a campaign, digital marketing provides accurate and real-time data on the performance of various marketing efforts. This allows businesses to make data-driven decisions and optimize their strategies to achieve better results. Additionally, digital marketing enables precise targeting, allowing companies to tailor their messages to specific demographics or consumer segments, increasing the chances of attracting the right audience.

Overall, digital marketing has transformed the marketing landscape, providing businesses with unprecedented opportunities for growth and success. The benefits of digital marketing are numerous, ranging from global reach and cost-effectiveness to data-driven decision making. Embracing this digital revolution has become essential for businesses looking to thrive in the online marketplace.

Overview of Online Marketing Platforms

Online marketing has revolutionized the way businesses promote their products and services. With the advent of digital technology, marketing efforts have expanded beyond traditional methods to encompass a wide range of online platforms. These platforms provide businesses with the tools and resources needed to reach a global audience, increase brand visibility, and drive sales.

One such platform that has gained popularity in recent years is "ZapMyWork," a freelance services marketplace. ZapMyWork serves as an online freelance marketplace for a variety of services, offering businesses the ability to connect with skilled professionals across different industries. Whether it’s graphic design, web development, content writing, or social media management, ZapMyWork allows businesses to easily outsource their projects and find the perfect freelancer for the job.

In addition to freelance marketplaces like ZapMyWork, there are numerous other online marketing platforms that cater to different aspects of digital marketing. These platforms provide comprehensive solutions for managing online advertising campaigns, analyzing customer behavior, optimizing website performance, and much more. From social media platforms like Facebook and Instagram, to search engine optimization tools like Google Analytics, businesses have a plethora of options to choose from when strategizing their online marketing efforts.

Overall, online marketing platforms have become an essential part of any business’s marketing strategy in the digital age. They offer convenience, efficiency, and a wealth of opportunities to expand brand reach and connect with targeted audiences. Whether it’s through freelance marketplaces or specialized digital marketing tools, businesses can leverage online platforms to enhance their marketing efforts and stay ahead in the competitive online marketplace.

Exploring ZapMyWork: A Powerful Freelance Services Marketplace

Introducing ZapMyWork, a dynamic platform that revolutionizes the way businesses and skilled professionals connect in the digital era. As an online freelance marketplace for services, ZapMyWork brings together a diverse pool of talented individuals and companies seeking specialized expertise.

With a focus on digital marketing, ZapMyWork offers an array of opportunities for businesses to leverage the power of online marketing. By tapping into this innovative platform, companies can discover professionals who excel in various marketing domains, such as social media management, search engine optimization, content creation, and more.

ZapMyWork not only facilitates the exploration of these digital marketing services, but it also provides a seamless experience for both entrepreneurs and freelancers. Through its user-friendly interface, businesses can easily search and find the perfect marketing expert to collaborate with, while freelancers can showcase their skills and attract potential clients.

By bridging the gap between businesses and talented individuals, ZapMyWork empowers companies to reach their target audiences effectively and efficiently. Through this powerful freelance services marketplace, the realm of online marketing becomes a world of endless possibilities for businesses seeking to stay ahead in the digital game.

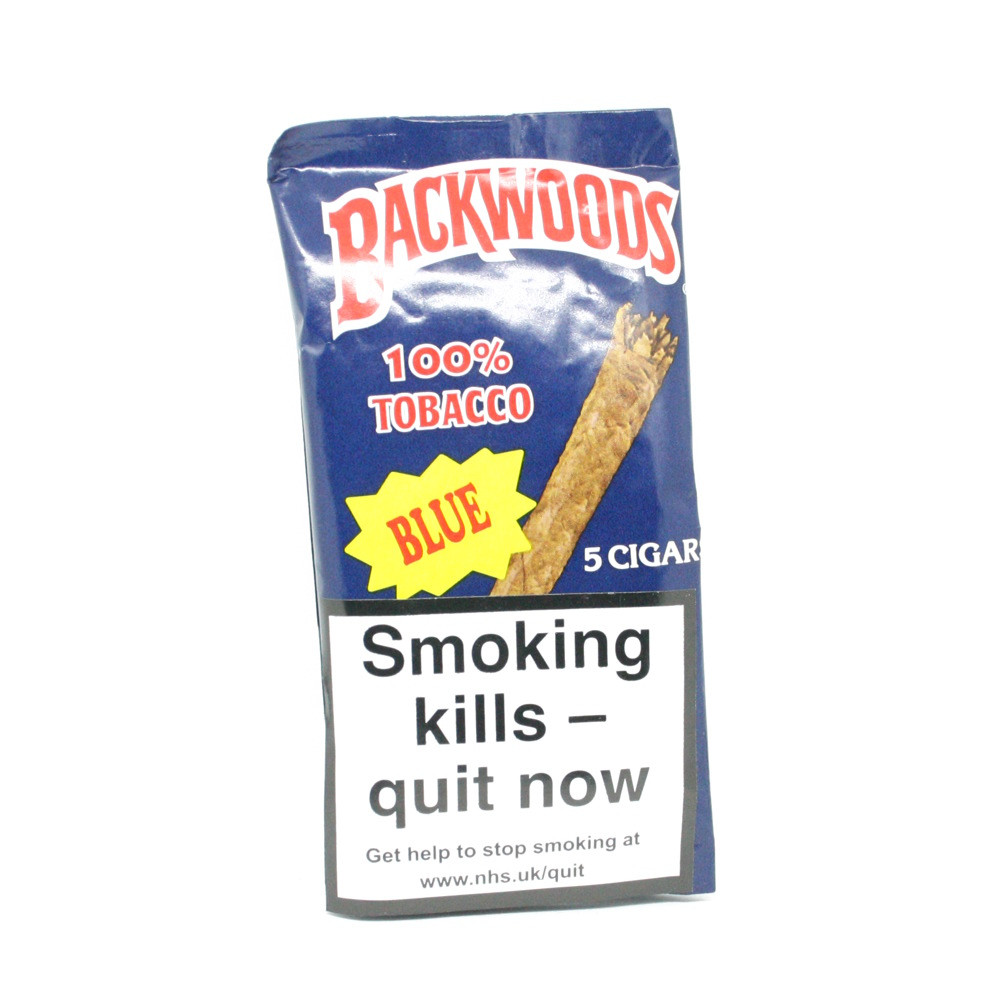

Uncovering the Rustic Charm of Backwoods Cigars

Nestled among the tall pines and winding trails lies a hidden gem that exudes a rustic charm unlike any other. Backwoods cigars have become synonymous with an escape from the everyday hustle and bustle, transporting enthusiasts to a simpler time filled with camaraderie and relaxation. With its humble origins tracing back to the rolling hills of southern America, these cigars have carved out a distinct niche in the world of tobacco, captivating aficionados with their unique flavor profiles and distinctive, rough-hewn appearance.

From the moment you lay eyes on a Backwoods cigar, your senses are enveloped in a world of rustic allure. Unlike their sleek and polished counterparts, Backwoods boasts a raw and unrefined aesthetic that immediately sets them apart. Wrapped in a rustic, homely Connecticut Broadleaf that varies in color and texture, each cigar tells a story of its own. The leaves themselves are often selected from the finest tobacco plantations, cultivated with care and seasoned to perfection, ensuring a consistent and satisfying smoking experience. Whether you opt for a classic honey bourbon or a bold and robust dark stout flavor, Backwoods cigars promise a journey that immerses you in a harmonious blend of flavors, transporting you to simpler times with every draw.

Steeped in history and tradition, Backwoods cigars capture the essence of a bygone era. These cigars pay homage to the rugged spirit of those who ventured into the uncharted territories of the wild, embracing the unpredictable and finding solace in the simple pleasures of life. With a rich heritage that dates back decades, Backwoods has evolved from a local treasure into a global phenomenon. As you ignite the handcrafted masterpiece and take that first puff, you are transported into a realm where time slows down, and the stresses of modern life dissipate, if only for a moment. So gather your friends, sit back, and savor the rustic charm of Backwoods cigars, as you indulge in a journey that transcends time and ignites the spirit of adventure.

The History of Backwoods Cigars

Backwoods cigars have a rich and fascinating history. Originally introduced in the 1970s, these cigars quickly gained popularity among smokers who were seeking a unique and rustic experience. The allure of Backwoods cigars lies in their rugged appeal and hand-rolled construction.

The roots of Backwoods cigars can be traced back to the Appalachian region of the United States. Inspired by the traditional art of hand-rolling cigars, the creators of Backwoods sought to capture the essence of the backwoods lifestyle. Each cigar is meticulously crafted using a blend of natural tobaccos, resulting in a distinctive flavor that sets them apart from other cigars.

Over the years, Backwoods cigars have become synonymous with adventure and exploration. Their association with outdoor activities and the rugged outdoors has made them a favorite among nature enthusiasts and aficionados alike. Whether it’s enjoying a leisurely hike or embarking on a fishing trip, Backwoods cigars have accompanied many memorable moments.

In recent times, the popularity of Backwoods cigars has reached new heights. They have become a symbol of camaraderie and relaxation, often enjoyed in the company of friends around a campfire. The blend of natural tobacco and their rustic charm continues to attract a loyal following of cigar enthusiasts who appreciate the simplicity and authenticity they offer.

In conclusion, the history of Backwoods cigars is one that spans decades of tradition and a love for the outdoors. Their hand-rolled craftsmanship and unique flavor have made them a beloved choice among those seeking a rustic smoking experience. Whether it’s taking in the beautiful landscapes or simply unwinding after a long day, the allure of Backwoods cigars is undeniable.

Characteristics of Backwoods Cigars

Backwoods cigars are known for their unique and rustic qualities that set them apart from other cigar options. These hand-rolled cigars exude a distinct charm that appeals to both seasoned cigar enthusiasts and newcomers alike.

-

Flavorful and Aromatic: One of the key characteristics of Backwoods cigars is their rich and robust flavor profile. These cigars are infused with a variety of enticing flavors such as honey, sweet aromatic blends, or even natural tobacco flavors. The carefully selected tobacco leaves used in the manufacturing process contribute to the cigars’ unique taste, enticing smokers with every puff.

-

Rustic and Natural Appearance: Backwoods cigars have a visually appealing appearance that adds to their charm. Their rustic, rough-hewn exterior is reminiscent of their roots, evoking a sense of authenticity and rustic charm. The natural tobacco leaf wrapping showcases the craftsmanship that goes into hand-rolling these cigars, making them visually distinct and inviting.

-

Compact and Portable: Backwoods cigars are designed to be easily carried and enjoyed on the go. Their compact size makes them convenient for outdoor enthusiasts, travelers, or anyone seeking a quick and flavorful smoking experience. The portable nature of Backwoods cigars allows enthusiasts to enjoy their preferred flavors anywhere, be it in the woods, amidst nature, or during a relaxing outdoor activity.

In conclusion, Backwoods cigars possess a range of characteristics that make them highly sought after by cigar enthusiasts. From their flavorful and aromatic attributes to their rustic appearance and portability, these cigars offer a unique smoking experience that captures the essence of the backwoods lifestyle. Whether you are a cigar connoisseur or simply looking to indulge in a distinct smoking experience, Backwoods cigars are definitely worth exploring.

Exploring the Flavors and Varieties

Backwoods cigars are known for their wide range of flavors and enticing varieties. These cigars offer a rustic charm that attracts enthusiasts from all walks of life.

-

Natural Flavor: One of the most popular flavors of Backwoods cigars is the natural tobacco flavor. These cigars offer a smooth and mellow experience with hints of earthy and woody notes. The natural flavor is a timeless classic that appeals to both seasoned cigar aficionados and beginners alike.

-

Sweet Aromatic Blends: Another enticing aspect of Backwoods cigars is their sweet aromatic blends. These cigars are infused with delectable flavors like honey, vanilla, and black cherry, enhancing the smoking experience with a touch of sweetness. The aroma of these cigars is sure to captivate your senses and leave you wanting more.

-

Limited Editions: Backwoods cigars also release enticing limited edition flavors from time to time, adding an element of exclusivity to their collection. These limited editions introduce unique tastes like apple, cinnamon, and rum, offering a delightful surprise to the adventurous smoker seeking a novel experience.

In conclusion, the flavors and varieties of Backwoods cigars are undoubtedly a key factor in their widespread appeal. From the classic natural flavor to the enticing sweet aromatic blends and exclusive limited editions, these cigars offer a diverse range of options to satisfy every palate. So, whether you are a fan of traditional tobacco taste or prefer to indulge in a sweeter smoking experience, Backwoods cigars are sure to provide a rustic charm that is hard to resist.

The Ultimate Guide to Maximizing Your Homeowners Insurance Coverage

As a homeowner, protecting your investment is of utmost importance. Having the right homeowners insurance coverage not only provides peace of mind but also safeguards you against unexpected circumstances that could damage or destroy your property. Additionally, homeowners insurance goes beyond just protecting your home; it can also offer coverage for personal belongings and liability protection. Understanding the ins and outs of your policy is crucial to ensure you have the maximum coverage possible.

While homeowners insurance is essential, it’s equally important to consider other types of insurance, such as car or auto insurance. Your home and vehicle are two valuable assets that should be protected comprehensively. By having both homeowners and car insurance, you can have peace of mind knowing that you’re safeguarded against various risks and potential financial burdens.

In this comprehensive guide, we will delve into the world of homeowners insurance and explore the ways in which you can maximize your coverage. From understanding the different types of coverage available to knowing what to do in the event of a claim, we will provide you with expert advice and tips to ensure you make the most of your homeowners insurance policy. Additionally, we will discuss the importance of having car insurance and how it complements your homeowners coverage.

Get ready to embark on a journey of knowledge and empowerment as we equip you with the ultimate guide to maximizing your homeowners insurance coverage.

Understanding Homeowners Insurance

Homeowners insurance is a valuable protection that every homeowner should have. It is designed to provide financial coverage for your home and its contents in case of damage or loss. Understanding how homeowners insurance works is essential in order to maximize your coverage and ensure you are adequately protected.

When you purchase homeowners insurance, you are essentially entering into a contract with an insurance company. In exchange for your premium payments, the insurance company agrees to cover certain risks associated with your home. These risks typically include damage from natural disasters, fire, theft, and other unforeseen events. It is important to carefully review your policy to understand exactly what risks are covered.

One important thing to note is that homeowners insurance is different from car insurance or auto insurance. While car insurance primarily covers your vehicle and liability in case of accidents, homeowners insurance is focused on protecting your home itself and its contents. However, some insurance companies may offer bundled policies that combine both homeowners and auto insurance for convenience and potential cost savings.

auto insurance grand rapids mi

In conclusion, homeowners insurance is a crucial safeguard for homeowners. It provides coverage for your home and its contents in case of damage, loss, or theft. By understanding the basics of homeowners insurance, you can make informed decisions when choosing a policy and ensure that you have the right coverage to protect your investment.

Choosing the Right Homeowners Insurance Coverage

When it comes to protecting your home, having the right homeowners insurance coverage is essential. With so many options available, it can be overwhelming to decide which policy is best for you. However, by considering a few key factors, you can make an informed decision.

Firstly, assess the value of your home and its contents. Take into account the replacement cost of your house, as well as the value of your belongings. This will help you determine the level of coverage you need. Keep in mind that while a higher coverage limit may mean a slightly higher premium, it can provide greater peace of mind.

Secondly, consider any additional coverage you may require. For example, if you have expensive jewelry or collectibles, you might want to ensure they are adequately protected. Additionally, if you live in an area prone to natural disasters, such as hurricanes or earthquakes, you may want to consider adding specialized coverage for these risks.

Lastly, compare different insurance providers and their policies. Look for reputable companies with positive customer reviews. Evaluate their deductible options, coverage exclusions, and any additional benefits they offer. It’s important to strike a balance between cost and quality, ensuring you are getting the best coverage for the price.

By carefully considering these factors, you can choose the homeowners insurance coverage that best suits your needs. Remember, this coverage is designed to safeguard your most valuable assets, so it’s worth investing the time and effort to make an informed decision.

Maximizing Your Car Insurance Benefits

-

Understand Your Coverage Options

When it comes to car insurance, it’s crucial to understand the different coverage options available to you. Familiarize yourself with the terms and conditions of your policy, such as bodily injury liability, property damage liability, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Knowing what each of these entails will help you make informed decisions about the level of coverage you need to protect yourself and your vehicle. -

Optimize Your Deductible

Your car insurance deductible is the amount you are responsible for paying before your insurance coverage kicks in. By choosing a higher deductible, you can often enjoy lower premiums. However, it’s essential to find a balance that works for your financial situation. Consider your risk tolerance and ability to pay the deductible if an accident occurs. Finding the right deductible can help you maximize your benefits while keeping your premiums affordable. -

Bundle Your Policies

If you have homeowners insurance and car insurance with different providers, consider bundling them together under one insurer. Many insurance companies offer discounts for individuals who purchase multiple policies from them. Bundling your policies not only streamlines your coverage but can also lead to cost savings. Before making a decision, compare insurance quotes and make sure bundling makes financial sense for your individual situation.

Remember, understanding your car insurance coverage, optimizing your deductible, and bundling your policies are all ways to maximize your benefits and get the most out of your car insurance. By taking these steps, you can ensure you have the right level of coverage to protect yourself and your vehicle on the road.

Review Of Vegas Red Online Casino

Anyone attempting to gamble online often feel overwhelmed the actual use of so many games accessible for them however; like aged adage goes, “only fools rush in”, rushing into an unfamiliar game makes any online gambler an idiot.

Poker88 Link Alternatif

(1) Many online casinos require you to download their software into a computer. Actually is fine because reputable online casinos provide safe downloads that never harm your particular computer. The download versions of online casinos often perform better than the other versions particularly without the quickest Internet add-on.

This Wild West themed casino started their business in 2008. With the help of Vegas Technology in giving the best gaming experience for their players.

Even though the odds associated with the individual number coming from European Roulette is one in 37, in case you watch 37 spins of your wheel, several numbers could have repeated themselves and several numbers won’t have appeared at nearly all. In fact, before all numbers have appeared once, at least one number will have appeared 8 times! Most amazing of all, it does not matter at what point you start tracking the numbers, or maybe if it’s American or European roulette. This is a very bold statement and I insist that you just to try it out any kind of time Casino, online or real, before you continue reading as this kind of is the premise of quick Roulette Application.

Baccarat, craps, and blackjack are games you’ll find at any Casino Online, several have low house edges. Blackjack is another “top three” game in popularity no more than internet on line casino. It’s easy, and developing a top notch blackjack approach is possible anybody willing vehicle insurance the strategy charts (which is different as card counting). One warning for beginning blackjack players end up being say “no” when the card dealer has an ace facing up and asks if you need to “buy insurance.” As a this, you’re betting that the dealer has natural blackjack (with a face card or 10 facing down), and the odds are heavily against that. Your property edge on insurance bets in blackjack is over 14%.

Do take breaks. It’s very easy permit time be a waste when you’re gambling on-line. Taking breaks not only helps think more alert, but it lets you reset your expectations. Sometimes taking one step back for most minutes will alert a person the idea you’re making unwise bets so you can stop.

More tables and more chances perform! If you have ever visited a real casino anyone then know how crowded the home or property can locate. With online poker there exists no long waiting periods for tables to responsive. Additionally, you can component in “multi tabling” and play several games without delay. Some experienced online players are equipped for up to 10 perhaps more games at the same duration. Don’t try this in Vegas unless you’ve mastered human cloning.